National debt explosion: The Fiscal Time Bomb and its Implications

US national debt has reached $35trn. Interest payments now exceed military spending and other secret service budgets combined. What are the implications?

Richard A. Werner, D.Phil. Sep 24, 2024 national-debt-explosion

Zürich, 24 September 2024. National debt [US md] has reached a new all-time high of $35 trillion, and counting. If you read this note a few weeks after I wrote it, the chances are the US will already have reached $ 36 trillion in national debt. Just check the debt clock. But make sure you sit down before you open this link, or else you might get dizzy – or weak in the knees.

Of course it is the largest absolute amount of national debt in the world, and in world history in real terms.

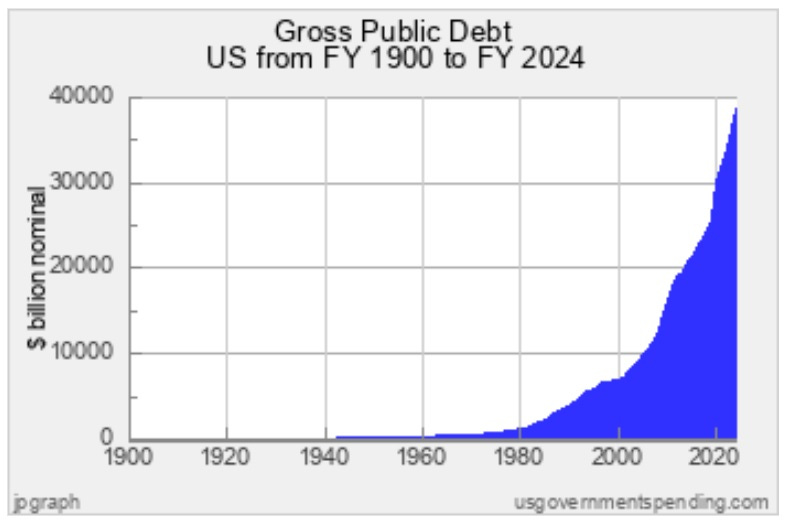

The exponential accumulation debt in recent years becomes especially obvious when we consider the long-term historical perspective as shown in this graph:

Since this US debt mostly takes the form of Treasury bonds issued with fixed promises to pay interest, the annual servicing cost of this national debt has now also reached historic proportions.

Interest payments on debt now exceed $ 1 trillion, ahead of military spending

According to the September 2024 US Treasury Bulletin, the U.S. government has spent over $1 trillion on interest payments for its nearly $35 trillion national debt so for this fiscal year, according to the Treasury Department. This is a new historical record.

Looking at the breakdown provided the September Bulletin published by the Treasury, which actually refer to the figures as at the end of June 2024, the gross interest on Treasury debt securities rose to $868 billion. We need to add interest payments on other obligations of $177 billion, giving us the world record high in interest payments of $1.045 trillion.

Given total fiscal expenditure of $5,027 billion, and total revenues from taxes, social security contributions and other sources amounting to only $3,754 billion, the deficit in the fiscal year to date by the end of June amounted to $1,273 billion. So gross interest payments of $1.045 trillion constitute 21%, more than one fifth of the total US government expenditure so far this year. At the same time, the interest payments amount to 82% of the US government budget deficit so far this year. This marks a 33% increase of gross interest payments by the government, compared to the same time in the previous year.

Since we have to add the significant budget deficits of July and August to these June data, with the August budget deficit alone surging to $380 billion, it seems highly likely that the 2024 US government budget deficit will exceed $2 trillion. The government’s official estimate of June 2024 that the deficit will come in at $1.9 trillion is likely to be overtaken by events, just as its debt forecast that national debt would only reach $35 trillion by the end of 2024 already has.

So where is all the US government expenditure going? Subtracting government investment earnings, we obtain net interest payments, which still amount to more than $800 billion, ranking just below Social Security and Medicare, and ahead of the spending by the Department of Defense, which used $608.6 billion. Even adding up the Deep State/military-complex departments of “Defense”, “Homeland Security”, “State Department”, “NASA” and “Independent Agencies” (including several of the 17 secret service agencies), the total comes in at $ 794.6 billion, still behind the government spending on interest payments.

Interest payments have jumped by 30 per cent over the same period last year. 2024 is indeed the first year in the history of the United States of America that payments to receivers of coupons on the government debt have exceeded expenditure on the military (US military spending being by far the largest in world, ca. nine times larger than Russian military spending).

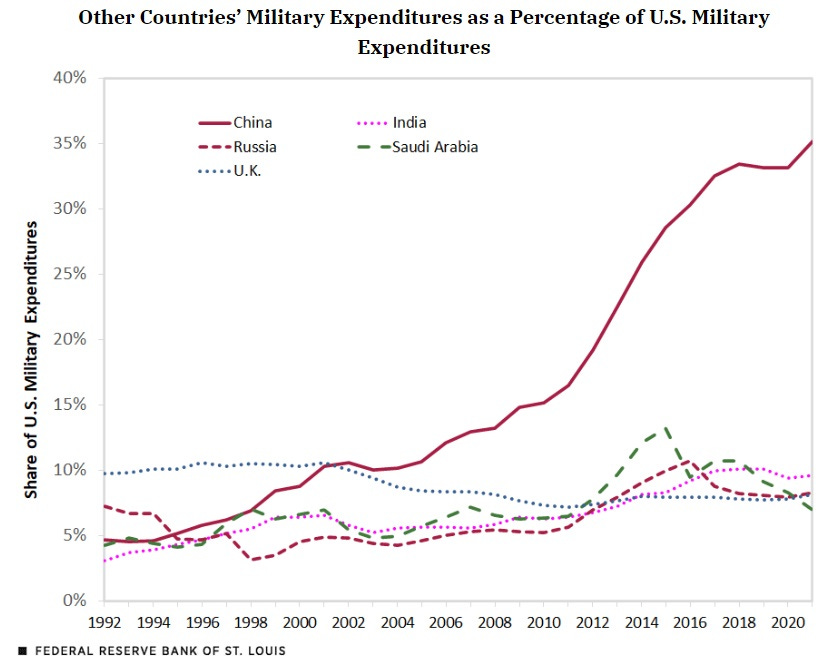

A publication by the Federal Reserve Bank of St. Louis knows how to present the massive military spending by the United States: The chart of the international comparison simply gives the US a different scale, alone among all countries whose expenditure is shown. This hides the fact that the US has by a long distance the largest military spending in the whole world.

Spot the presentation trick

Servicing the national debt via interest payments is well on track to soon becoming the single most dominant share of Washington’s budget. Governments often like to hide the interest payments when they present their spending, by restricting the displayed information to “non-discretionary spending”, which conveniently excludes interest payments. Remember, we are no dealing with governments that believe merely “explaining” things properly to us, ideally using behavioural psychology (i.e. mind manipulation) and propaganda, in order to feed us the one and only truth, while any critics by definition utter “misinformation” or “disinformation” that is rapidly being outlawed in Europe, Australia and perhaps even the US.

Elon Musk: America is going bankrupt extremely quickly (9 September 2024)

On 9 September, Elon Musk expressed deep concern about the acceleration in the accumulation of national debt in the US and the fact that interest payments alone now exceed military spending. He also noticed that it now only takes ca. 3 months to add another one trillion dollars to national debt.

“America is going bankrupt extremely quickly. …Interest payments on national debt just exceeded the Defense Department budget, but they’re over a trillion dollars a year. Just in interest. And rising. We’re adding a trillion dollars to our debt, which our kids and grandkids will have to repay somehow, every three months. And then soon it’s going to be two months, and then every month… And then the only thing we will be able to pay is interest… This is not a good ending.”

Already in January this year Elon Musk had stated: “I am alarmed by the US debt”. It stood at $ 34 trn then. On 3 May this year he stated:

“We need to do something about our national debt or the dollar will be worth nothing.”

This national debt is as large as 90.3% of annual GDP. By international comparison, as percentage of GDP, US national debt is therefore significantly larger than that of Liechtenstein (0%), Russia (19.6%), Saudi Arabia (34.6%), Indonesia (46.2%), Turkey (48.3%), Switzerland (48.6%), Norway (50.1%), South Korea (57.8%), the Netherlands (60.3%), Poland (62.1%), Ireland (63.5%), Mexico (66.5%), Australia (67.4%), Germany (80.3%), or China (82.5%).

It is of similar size as the national debt of Argentina (93.5%), and not very far behind the national debt of the United Kingdom of Great Britain and Northern Ireland (110.1%).

The good news is that US national debt as percentage of GDP is still smaller than this debt metric for Canada (130.3%), Spain (136.2%), Portugal (146.6%), Greece (230.2%) or Japan (302.3%), so some commentators feel the US can continue to max out on debt. Of course this ratio hides the fact that the US is a much larger economy than the others and the figures in absolute terms are unrivalled.

Moreover, one can argue that the number of countries with worse metrics than the US is smaller, since Spain, Portugal and Greece, as eurozone members, are seen by many in the markets as essentially being underwritten by German tax payers. This leaves Canada and Japan as the only major debtors with a larger national debt as percentage of GDP. Canada is a much smaller economy and hence not a good comparison.

Why large national debt is often said not to matter

Many economists claim we need not worry about national debt. For instance, when national debt in many countries surged in 2020, due to massive increases in government spending, this was not thought to be cause for concern.

Paul Krugman, for instance, honoured by the Swedish central bankers’ prize in memory of Alfred Nobel, was sure that it wasn’t anything to worry about.

Japan owes its debt mainly to domestic borrowers, and hence is not exposed to the risk of a debt boycott by foreign investors or a speculative attack by foreign investors. In the US case, foreign investors have long been very important as buyers of US Treasuries. But unlike almost all other nations borrowing from international investors, the United States debt is denominated in its own currency. This also ensures that, in dollar terms, the US will technically always be able to service and repay its debts: If pressed, the Federal Reserve, the US banks or the US government could always simply create $35 trillion in US dollar credit and by printing the money avoid a default.

Why national debt does matter

There are several reason why national debt does matter. Here is one: Almost a century ago, John Maynard Keynes looked ahead and made predictions a century into the future. He predicted that productivity growth would generate national income output of such proportions that people would no longer have to work. His ultimate prediction that we would not have to work was obviously wrong. But his calculation was correct: productivity rose as much as he predicted. National income expanded by the upper end of the range he forecast. So why do we still need to work? Not even Keynes could have predicted that the fruits of this higher productivity and labour would be so unequally distributed that the majority of the population would still have to work. While a small minority has not been working for a long time – they simply receive coupon payments on their government bonds – most people still have to dedicate their time to earning a living.

Keynes did not see this coming, because the aggregate measures, such as national income, GNP or per capita income, hide the extent of inequality. Even if all the benefits of economic growth accrue to only one person and all the others get no benefit, per capita GDP would show the same rise.

The mechanism for the increased inequality and the accelerating trend of transferring wealth from the many to the few is the financial system, via interest. It is mainly the interest on the national debt. This has increased dramatically since the creation of central banks. Before the creation of central banks governments could issue national currency and therefore fund fiscal spending without having to pay interest. When the Federal Reserve was created in 1914 (decided in December 1913), the deal was that instead the government would now borrow at interest. That is why the Federal income tax was introduced for the first time in the US when the privately-owned Federal Reserve banks were established. It was the same when the Bank of England was founded in 1694. In fact, the act that established the privately-owned central bank did not mention the “Bank of England” by name, but had a lot to say about the introduction of new taxes.

When government leaders challenge this system of transferring money from the many (tax payers) to the few (bankers and bond holders), namely by issuing state money again, drastic measures are usually taken to stop this, as I explained in my Deep State substack article.

Of course, the rentiers living off bond coupons love to hire economists to say that national debt doesn’t matter. They may even sponsor entire schools of thought saying this. This simply supports the racket to loot the majority at the expense of a minority.

When interest payments become the largest spending item of the annual budget, then we have reached the late stage in this process of redistributing wealth from the many to the few. It does mean that an increasing number of stop-gap measures will be used to extend the lifetime of the system and delay the ultimate collapse.

The US dollar as the ultimate measure of debt sustainability

The ability of the US to always create money and hence avoid a technical default on its massive national debt is exactly why the sustainability of the US debt is ultimately measured by the strength of the US dollar: If too many dollars are being created, for instance to service or repay the debt, its value and credibility will decline.

The US dollar exchange rate, like all FX, is a relative price: It depends also on the relative value of other currencies. Key historical rivals are the euro and the Japanese yen, as well as, to a lesser extent, the British pound and the Swiss franc. Furthermore, an alternative to the dollar could emerge from the BRICS economies, although China has recently proven to be susceptible to US pressure (TikTok closed down the Russian news channels RT and Sputnik, showing a Chinese preference to appease the US rather than stand up for military ally Russia). After all, the Chinese yuan is pegged to the US dollar, and so is the Hong Kong dollar. This is to remind us that even the Saudi Arabian currency remains firmly pegged to the US dollar. Thus so far the US dollar remains well entrenched.

Furthermore, as I have documented, the US has kept the dollar strong by its policy to cannibalise occupied vassal countries Germany and Japan. The yen, in particular, has been used as a vehicle for currency debauchment to strengthen the relative value of the dollar. While currency intervention by the Ministry of Finance has stopped the extraordinary decline of the yen at Y162/$, followed by a rally of the yen to Y139/$. The yen has in recent days however given way again, weakening to as low as Y144.5/$ on 22 September 2024. In other words, the game of yen carry trades that weakens the yen and supports the US dollar has commenced again, despite announcements by the Japanese Finance Ministry that it will be ‘vigilant’ against re-emergence of the carry trade. It has already re-emerged.

The weakness of the yen and, to some extent, also the euro have supported the dollar. I have discussed the yen weakness in another substack article. The euro has also been kept weak, though less dramatically so, by the extraordinary implosion of the Germany economy engineered by the German government and the well-timed pricking of the ECB-created property bubble in Germany in October 2022, followed by the ongoing collapse of the real estate market and coming collapse of the German banking system – which will take another 2 to 3 years to become public knowledge. The dollar has also been supported by the ongoing presence of US troops in Saudi Arabia that have ensured the continuation of the Saudi dollar peg. Please read my earlier substack article on the Petro Dollar.

Dollar strength only relative – the true measure of dollar value is the gold price

Thanks to the skilful manipulations of monetary and oil policies, the dollar has nominally been strong since 2020, especially against the yen and euro. But this is a replay of the post-1971 tricks, as the inflation we have since experienced testifies. We can also see the underlying weakness in the strength of the Swiss Franc. But most of all we can see it in the price of gold: One could say that it is not the gold price that has been rising to new all-time-highs in US dollar-terms this month, but it is the dollar that is falling, while gold has stayed unchanged in value.

The rising US national debt is likely to support the gold price further. As I have written in greater detail before (see my gold substack), I expect the gold price to continue its rise. It has been artificially suppressed for quite some time, especially blatantly in 2020. I continue to believe that a gold price even of $10,000 per ounce would not appear unusual in the coming years. As a side-effect, cryptocurrencies are also likely to benefit similarly, although investors need to be aware that these do not constitute “digital gold”, as they are often marketed as. The essence of gold is analogue and includes physical possession as a core feature.

Why has fiscal policy been so ineffective – thus boosting debt-to-GDP ratios?

Such measures as debauching the yen and using US control over Saudi Arabia are stop-gaps, especially in the current geo-political environment. They are able to extend the rule of the US dollar – perhaps for longer than many expect. But what is the end-game?

Before we come to that, let us resolve an underlying puzzle that is closely connected to the recent surge in national debt in the US and other major economies, including Canada, France, Germany and indeed Japan: One reason why national debt has shot up so rapidly and debt-to-GDP ratios have escalated is because substantial and partly unprecedented government spending programmes – some launched under the pretence of some declared health emergency – have not resulted in the kind of economic expansion that many economists had expected.

Remember that just before the March 2020 unprecedented restrictions of individual freedoms in Europe and North America, as well as other regions, based on nonsensical and largely evidence-free justifications, the consensus among economists had been that expanded fiscal spending was a good way to stimulate the economy. This had recently become a consensus that even fiscal hawks would agree with in the short-term and under emergency conditions. That is of course how the 2020 fiscal spending splurge was explained.

There is a new marketing front for Keynesianism that has been deployed to further bolster the claim of fiscal policy effectiveness: Even the previously fiscally conservative Financial Times has in recent years been busily propagating the theories by so-called “MMT economists” who proclaimed that there was little down-side to expanded government spending. MMT economists and supporters are, of course, Keynesians who had re-branded themselves, as apparently Keynesianism was considered with suspicion in many quarters in the US.

A key idea of this MMT-Keynesianism has been that one need not worry about fiscal deficits. This is repeated daily by an army of online warriors with “MMT” in their profile, and many without it. An example from Twitter/X just now:

Proponents of MMT assert that fiscal deficits are not a bad thing and national debt is nothing to worry about. Instead, they have been demanding ever greater fiscal spending – a message happily received by politicians in many countries. They have been advising anyone who would listen that government spending should be increased, as this would stimulate economic growth and result in prosperity. Expanded fiscal expenditure has been touted as the magic bullet to solve all sorts of problems.

Well, the MMT-fans got what they had been passionately demanding: massive expansions in fiscal spending, and the consequent surge in national debt. But MMT-fans and most macroeconomists in general have been surprised by how small the positive effect of the largely unprecedented fiscal spending has been on economic growth.

MMT analysis ignores role of supply-determined credit creation

Given that Japan has been ahead of the curve in terms of excessive government spending and spiralling national debt, a brief review of the debates here is useful. Sadly, the MMT-fans had failed to look into this Japanese experience, which had forewarned us of the dangers, costs and missed opportunities of massive fiscal expansion.

In Japan, the biggest MMT-fan is an analyst called Richard Koo, who already in the 1990s demanded greater fiscal spending in Japan and has since kept up his call for fiscal expansion that he has been rattling like a mantra. In fact, he has been demanding greater fiscal spending also in other countries, including the US and today demands that China step up its government spending.

So let’s go back to the debates about macroeconomic policy of the 1990s, when Richard Koo first presented his arguments to a larger audience. Essentially, he repeated the argument by the Bank of Japan that interest rate reductions, as were already happening from 1991 onwards, were going to be helpful, but that they needed to be backed by significant expansion in government spending.

Sadly, the government listened to him. In the 1990s, Japan’s government embarked on what was then the world’s largest peace-time government stimulation programme, lasting many years. It didn’t work. The economy failed to recover. Koo’s response: the fiscal spending has not been big enough! We need more fiscal expenditure! With the ratio of national debt to GDP in Japan in excess of 300% nobody can argue that fiscal policy has not been attempted. But the extraordinary fiscal expansion failed to trigger the economic recover that had been predicted.

Despite a lost twenty years of close to zero growth, to a large extent due to such bad policy advice, Koo has single-mindedly kept up his failed recommendations. The quip often attributed to Einstein comes to mind that doing the same thing over and over and expecting a different result is insanity. The Bank of Japan certainly suffered from this problem: Having lowered interest rates, and as this failed to stimulate the economy, the central bankers lowered them some more. Then, when this failed to work, the central planners came up with a new plan, which was to lower interest rates. Then, when this failed to stimulate the economy, they tried something else, namely to lower interest rates. After that, they lowered rates some more. After a dozen interest rate reductions in the 1990s alone, at least some discussions about the need for alternative approaches began to be heard by the central planners.

By contrast, the Keynesians have not contemplated alternatives. When ever larger fiscal stimulus packages failed to stimulate the economy, the government planners dreamed up further stimulus packages.

When one studies economics, it is one of the highlights of first year economics courses that Keynes is said to have shown that government spending operates with a “multiplier”. In other words, the impact on economic growth any given government spending package is larger than that original spending package. The effect is “multiplied”.

However, over the past three decades any such “fiscal multipliers” have been falling. For the last 15 years, they have been less than 1. This means that there no longer is any multiplication effect. To the contrary: empirical research shows that the positive impact on economic growth of any given amount of fiscal spending is significantly less than the fiscal spending. What is more, I demonstrated already in the 1990s that Japanese fiscal spending resulted in an equally-sized shrinkage of private sector spending so that total GDP growth remained unchanged: government spending was fully crowding out private demand. See also here and here.

As I have explained in my publications, fiscal policy took away limited resources from the private sector, forcing private demand to shrink. I also solved the puzzle of the ineffectiveness of interest rate policy and the ineffectiveness of government spending policy: The proponents of fiscal spending and interest rate reduction policies did not describe the functioning of the economy correctly. Economic growth is not actually driven by interest rates, nor does pure fiscal policy cause economic growth. Instead, economic growth is driven by bank credit creation for the real economy.

In Japan, banks had sharply lowered bank credit growth since the early 1990s, because they had created too much credit for asset purchases in the 1980s, and that had caused an asset bubble, mainly in real estate, which collapsed not long after such bank credit creation slowed in 1989. We then had to expect ever increasing non-performing loans in the banking system, which would reduce bank credit creation and worsen the asset deflation, cause a property price collapse and a decline in economic growth, a rise in unemployment and end up in a general slump – until the root cause of the problem is addressed, which I had pointed out in the early 1990s and during my time as chief economist of a British investment firm in Tokyo, was a lack of bank credit for the real economy.

I argued that interest rate reductions, even to zero, would not work, and neither would expand government spending. The latter would merely boost national debt and thus cause long-term burdens and problems.

Instead, between 1994 and 1998, I proposed a new monetary policy to kick-start bank credit creation for the real economy, which I called “Quantitative Easing”. An early publication that received much attention was my article on 2 September 1995 in the Nikkei (Japan’s leading financial newspaper, with the Nikkei group now also owning the Financial Times). It was noted by many economists, including Richard Koo, but also Ben Bernanke who had joined the debate in the Nikkei.

Richard Koo was quick to call it “nonsense” in his Nikkei response. He denied that banks are special and that a banking crisis was likely or could depress growth for a long time. Koo stated emphatically that I was wrong and that in Japan the problem was not a lack of bank credit. Instead, he argued, Japan’s government merely needed to increase government spending.

By contrast, I had explained that the recession would continue as long as bank credit creation was zero or negative, and no amount of fiscal stimulation or interest rate reductions would do the job. In the event, the Bank of Japan famously lowered interest rates, from an initial high of 7% in 1990, to 0.001% by the early 2000s. All to no avail: Since bank credit creation continued to shrink, the economy failed to recover, just as I had explained.

While the fiscal spending thus did not succeed in stimulating the economy, it caused a massive build-up of national debt.

It should be noted that the MMT crowd are also wrong on other matters. For instance, they claim that the central bank is part and parcel of the government and thus refuse to analyse central banks and their decision-makers or owners, separately. This is astonishing when in the US, a stronghold of this fake economics, the central bank is 100% privately-owned!

Next, despite MMT people being aware of my work, they refuse to disaggregate credit and thus reject the accurate disaggregated quantity equation, which is the General Quantity Equation that I have presented since 1992 and empirically tested in many countries. They still prefer the failed conventional quantity equation, which I have demonstrated more than 30 years ago is merely a special case that has not worked well since the 1960s, as it wrongly assumes all money is spent on GDP transactions. In actual fact since then non-GDP transactions have expanded significantly. For more on this, see my work on this here, here and here.

There is always demand for credit

Finally, MMT people and many post-Keynesian economists advance empirically disproven fallacies, such as the idea that the money supply or credit supply is demand-determined. Such commentators argue in all earnestness that banks and also the central bank cannot increase the money supply or create more credit on demand, since the demand for money is limited and indeed is the limiting factor. This is quite a ludicrous idea, given that 99% of companies are small and medium-sized enterprises that are known to be credit-rationed, given their small size. It is also laughable, when we see the sheer insatiable demand for money by governments that surely are the preferred option for the providers of credit and money, given that governments can impose new taxes to service and repay any loans. Further, it is a simple fact due to the aggregation of individual demand (and supply) functions to obtain “the market demand”: Since my demand for money and credit is very large, just short of infinite, this means that the aggregate demand for money is also very large, even though I grant that others may possibly have a far lower demand for money. (I demand such money for philanthropic projects and to establish a network of local community banks, by the way!).

Finally, Stiglitz and Weiss (1981) have long demonstrated that due to the legal construct of limited liability of directors there will always be demand for money that, in fact, is not fully met, since the lenders do not know who is a reliable borrower who will do all they can to service and repay the loans and who has no such intensions. As a result, the demand for credit and money is so large that there cannot be equilibrium, Stiglitz and Weiss (1981) explained: Prices move to ensure equilibrium, but given such a high demand for money and credit, the equilibrium interest rate would have to be very high indeed. That, however, is something banks or other lenders would intentionally avoid: If interest rates are high, the conservative, honest borrowers will drop out and lenders are left with the high-risk or disingenuous borrowers who are more likely to result in non-performing loans. Consequently, banks keep the loan interest rate low (below a theoretical equilibrium level) and instead ration credit. In rationing, the short-side principle applies, which means that quantity of demand or supply that is smaller determines the outcome. Indeed, the short side has power – the power to pick and choose with who to trade (a power often abused, when you consider markets with extreme rationing, such as the market for very highly paid, but quite easy jobs, such as being a Hollywood actor or actress; the employers or producers are the short side and extract their pound of flesh from those willing to throw it into the deal so the short-side allocators decide in their favour).

In the case of the market for credit or money the short side is the supply. Hence banks, and their regulators, the central bank, have overarching power in the economy. This makes it crucial what the structure of the banking sector looks like and what sort of central bank a country has.

I have also disproven the MMT claim that central banks cannot increase the money supply if there is no demand for money. One such proof was the formulation of my QE proposals, which I originally designed for Japan, but which have since been implemented and elsewhere, mainly by the Federal Reserve.

Crash course on QE

To recap, I used my General Theory of Credit (aka the Quantity Theory of Disaggregated Credit) to warn in late 1991 that Japan, which then enjoyed circa 7% GDP growth, and whose top 10 banks were also the largest 10 banks in the world, was likely to experience a banking crisis, an economic depression and large-scale unemployment, if the right policies to counter this were not taken (see my Oxford University Institute of Economics and Statistics Discussion paper no. 129: Richard A. Werner, The Great Yen Illusion: Japanese foreign investment and the role of land related credit creation. October 1991).

This analysis was written up positively by Clive Crook, then deputy economics editor at The Economist, who produced a well-written Economics Focus article about it.

It took until 1997 for more economists to be willing to entertain my dire predictions about Japan (even though some, as explained above, argued that government spending was the solution – but then, these people had not even predicted the downturn, so why listen to their policy recommendations?).

I had already been convinced by 1994 that things would get really dire, if the central bank did not take the right policies to avert this. So I formulated those necessary policies. The shortest version is my two-step QE program:

- QE1, my recommendation for the central bank to purchase non-performing assets from banks at face value.

This immediately takes care of the root cause of the problem: The excessive bank credit creation of the 1980s, namely when banks created unprecedented amounts of money for borrowers to purchase real estate and land, thus driving up land prices and creating an unsustainable asset bubble. Such bubbles, always driven by bank credit for asset purchases, last while and as long as bank credit creation for asset purchases continues to expand. As soon as the tap is closed and the music stops, the most recent late-coming speculators will get in trouble: Asset prices will not rise further. As non-performing loans start to accumulate, banks reduce such bank credit, so that asset prices actually fall. Having been pushed up by several hundred percent, they only need to fall by ca. 15% for the banking system to be bust, since non-performing loans have to be replaced by bank equity, which was less than 10% of bank balance sheets.

However, given the scale of the problem I concluded that even this measure would not be enough to kick-start bank credit again, as loan officers would personally still be shell-shocked and likely be far too conservative. Hence I proposed

- QE2, my recommendation for the central bank to purchase performing assets from non-banks.

This is the simplest way for a central bank to expand credit creation and the money supply, even without the need for active cooperation from the banks (normally the main or even only creator of the money supply). I suggested in 1995 that, given the looming collapse of the real estate sector and the fact that Tokyo remained very built-up and without enough parks or green areas, the Bank of Japan should simply purchase land in central Tokyo and turn it over into “BoJ parks” open to the public. As the sellers of the land usually would not be banks, when the central bank gives instruction to pay them, their bankers would receive transfers of reserves and the instruction to credit the deposit accounts of these former land owners. Hence this QE2 directly boosts the money supply by creating new deposits, and banks or even those who “demand money” in the eyes of the post-Keynesians are irrelevant in this process.

Of course, as my readers will know from my book Princes of the Yen (available only at www.quantumpublishers.com), the Japanese central bank refused to take my advice of QE1 and QE2. The twenty-year recession could have been entirely avoided. Already in 1995 the incipient banking crisis and looming recession could have been averted so that there would not have been any downturn at all in Japan.

Why have central banks chosen to create large crises and business cycles?

Some readers not familiar with history might ask: But can we really expect central banks to purchase non-performing assets from banks at face value? And can we really expect central banks to implement such a dramatic policy as my QE2 policy of directly forcing money into the economy via the banking system without needing cooperation from the banks?

The answers are yes and yes. Concerning QE1, this had already been pioneered by the Bank of England: After the United Kingdom of Great Britain and Ireland had declared war on Imperial Germany, the Austro-Hungarian Empire and the Ottoman Empire in August 1914, it turned out that since many of the bills of exchange and other debt securities issued within these large economic areas were being traded via financial centre London, many a London banker was bankrupted by the British declaration of war: this rendered these papers enemy paper considered in default since foreclosure could no longer be enforced. To avoid the collapse of the UK banking system in August 1914, which would not have been a propitious moment, the Bank of England bought the paper at face value (and also ensured that the Treasury did the same, even allowing the government temporarily to issue government paper money, a point I shall return to below; the latter was a measure to limit Bank of England paper issuance and with it potential criticism of BoE policy).

In the last report on the Deep State I included a discussion of the alternative system, whereby the state would not issue government bonds, and instead issue state money (like the US Notes issued by JFK in 1963, or by Italian government leader Aldo Moro in later in the 1960s), which do not include any promise to pay interest.

But of course the idea of having a privately-owned central bank that has some kind of monopoly over the issuance of paper money is that in such a system the government gives up its powers to issue state money and delegates this to the private entrepreneurs, who then can charge interest to the government. Such sovereign lending is more comfortable business than the most productive and effective way of bank lending, namely bank loans to small firms for productive business investment. Instead of having to check the loan applications of thousands of small companies, the central bankers merely deal with one client, the state, and they don’t have to worry as much about the possibility of default, because unlike private companies, the state can impose new taxes on the population and thus ensure they will pay the bond holders their pound of flesh. This is why the introduction of central banks usually coincided with the imposition of new taxes.

Therefore the national debt is the desired result of a system put in place with the creation of the privately-owned Federal Reserve banks (dominated by the Federal Reserve Bank of New York) 110 years ago. The system is one of extraction of purchasing power and wealth from the rest of the economy for the benefit of a miniscule minority. One extraction mechanism is the direct transfer of interest payments. Others include the power to create cycles, booms, recessions and crises, and using this to engineer other changes, ranging from further wealth transfers from the many to the few.

Secondly, it is true that the monopoly bankers (the controllers or founders of the central banks and their heirs) usually do not want to overdo their extraction of pounds of flesh from the economy or society. They do not want to kill the cow that is being milked. As a result, a system has been put in place to impose always the highest level of interest that would not cause a debt trap. This is an interest rate that follows nominal GDP growth – which explains the empirical finding that interest rates follow nominal GDP growth, positively, and are roughly equally large.

Enhanced Debt Management: How to make fiscal policy effective

The issuance of state money is a method to make fiscal policy effective: There cannot be any crowding out of private investment if government spending is not funded by the issuance of bonds that are bought by the non-bank public, but instead by the money creator. Ideally the state itself. But those politicians who dared to issue state money have not done well – in the case of large economies (JFK in 1963 and Aldo Moro a few years later).

However, there is a low-profile method to achieve almost the same, namely boost the effectiveness of fiscal policy in stimulating economic growth, so that the deficit-to-GDP ratio and also the national debt-to-GDP ratio improve significantly: The government stops the issuance of government bonds and instead funds the public sector borrowing requirement by borrowing from domestic banks via non-tradable loan contracts. More on this here.

In other words, it is quite possible, in fact not difficult, to render fiscal policy highly effective and thus reduce the deficit/GDP and debt/GDP ratios. But the principle of Revealed Preference tells us that the central planners do not wish to do this. Instead, they have chosen to boost national debt in the US and other countries by record amounts. This is likely part and parcel of the plan to dethrone the US dollar, in order to introduce a global central bank digital currency system – a dystopian nightmare of total full-spectrum control over our lives, as we would be forced into a ubiquitous digital prison (see my substack here).

The risk of global war is high as Deep State seeks to evade the dollar conundrum

As the debt spiral continues, Germany and Japan are cannibalised further to sustain dollar strength in the face of an unsustainable debt build-up. Where is this scenario heading? What is the plan?

The Deep State appears to prefer external crisis in the form of a global war as the excuse to collapse the debt Ponzi scheme. In the past, war was a frequent such exit strategy, even though the war first accelerates the debt spiral further. After the war it may well be followed by the catharsis of hyper-inflation.

The second assassination attempt on Donald Trump underlines our analysis in the Substack Deep State report.

The Deep State apparently seeks to escalate current wars into a global world war, by having ally Israel step up bombing of neighbouring countries (ongoing bombing of Gaza, Syria, Lebanon, Iran etc.) and getting the UK to permit the use of the Storm Shadow rockets by Ukraine (which means UK entry into war against Russia, as Ukrainians cannot program, steer or fire these rockets, it has to be done by British or NATO experts).